In recent years, the shrimp farming situation in the world has been developing with over 50 countries and typically the 5 leading ones have the most impressive numbers for shrimp farming in the aquaculture industry.

Shrimp is one of the most economically valuable seafood products in the world. In 2024, global farmed shrimp production is expected to reach about 5.1 million tons, with major contributions from Asian and American countries. The global shrimp farming industry is undergoing many changes, with different challenges and opportunities depending on the country and region. Let’s find out these countries leading in shrimp farming.

- ECUADOR

Currently, Ecuador is still holding the top position in the “golden list” of shrimp farming and shrimp exporting in the world with a journey of more than 50 years since 1969.

After many failed shrimp farming models, Ecuador implemented a new method of capturing juveniles from estuaries and transporting them to breeding tanks within 4-8 months for production and trade. This is also the foundation for the global revolution in the shrimp farming industry.

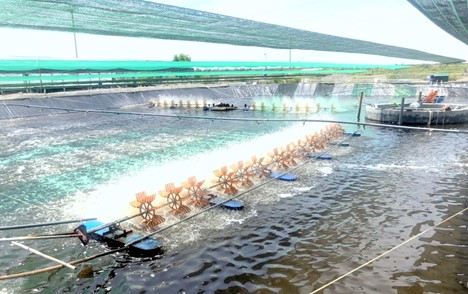

Image of shrimp farming

In addition, there is a shrimp farming model that uses the method of zoning farms and avoiding environments near mangrove forests, instead building shrimp ponds in areas with higher terrain.

Ecuador’s shrimp production in 2023 is estimated to reach 1,450,000 tons. Ecuador maintains its position as the world’s leading shrimp producer and exporter, with the majority of its production going to major markets such as China and the United States.

Ecuador is expected to grow production by 7% by 2024. Despite the strong growth, the country still faces risks from the El Niño phenomenon, which could affect pond infrastructure.

- INDIA

After ceding the shrimp farming championship to Ecuador, India fell to second place in the world shrimp farming industry.

Currently, this country has been applying a series of high-tech techniques in shrimp management and farming to increase work efficiency as well as output. The shrimp farming model is relatively small, only about 0.2 – 0.5ha/pond and each farm has 2 – 4 ponds. However, the second main harvest of India is expected to yield lower than normal, estimated at only 50% of the first crop.

India’s shrimp farming industry output by 2023 is estimated to be around 900,000 – 950,000 tons. The challenges India faces during this time range from high input costs, falling market demand, and a shift in shrimp species (reduction in vannamei and increase in monodon).

India’s shrimp farming industry is expected to recover slightly in 2024, with an expected growth of 2%, bringing production to around 920,000 – 970,000 tons. This recovery is expected to come from improved market demand and shrimp prices.

- INDONESIA

Indonesia has been one of the largest shrimp producers in Southeast Asia since the 1980s with its roots in black tiger shrimp farming.

In recent years, the country has been moving towards a circular shrimp farming model with a diameter of 5-30 meters, a frame built of steel mesh or bamboo and lined with HDPE inside. This model is popular with young and small-scale farmers with the advantages of easy water circulation, faster waste removal and easy application of new technology.

Image of shrimp farming

Indonesia’s farmed shrimp production in 2023 is estimated to reach around 800,000 – 850,000 tons. In 2023, Indonesia will face many of the same challenges as other countries in the aquaculture industry, including high feed prices, climate change and price fluctuations in the international market. However, Indonesia will maintain a strong position thanks to its large-scale production capacity and growing export markets.

It is expected that in 2024, Indonesia’s shrimp production will grow by about 3.6%, bringing output to about 830,000 – 880,000 tons. This growth is based on increased production capacity and continued expansion of export markets, especially towards major countries such as the US and China.

Indonesia is stepping up the adoption of modern technology in production and looking for more sustainable solutions to maintain its important role in the global shrimp market.

- CHINA

China’s shrimp farming industry is currently recovering from the difficulties caused by the pandemic and the global economic downturn in 2023. China’s shrimp production is expected to struggle in 2023, with growth slowing and many farms facing price and market demand problems. However, China remains one of the world’s largest shrimp producers, meeting both huge domestic demand and export markets.

Image of shrimp farming

China’s shrimp output in 2023 is expected to decline slightly, reaching around 800,000 – 850,000 tons, largely due to the impact of disease on shrimp farms and falling shrimp prices.

In 2024, China’s shrimp farming industry is expected to grow slightly, with an increase of about 1.9%, bringing output to about 830,000 – 880,000 tons.

China is still investing in modern farming technology to improve efficiency and reduce risks from disease and climate change. However, the industry remains heavily dependent on prices and demand from major markets such as the US and EU, as well as growing domestic demand.

- VIETNAM

Since 1990, Vietnam has continuously developed shrimp farming in both farming models and techniques. In 2023, Vietnam’s shrimp output will reach about 700,000 – 720,000 tons, decreased by about 15%, due to many challenges from high production costs, the impact of climate change, and disease problems.

It is expected that in 2024, Vietnam’s shrimp farming output will recover with a growth rate of about 6%, bringing output to about 750,000 – 760,000 tons. This recovery is thanks to improved farming techniques, better disease control, and increased international market demand.

The Vietnamese government is also promoting the transition from traditional shrimp farming models to more sustainable models such as ecological shrimp farming and high-tech shrimp farming to increase productivity and reduce environmental impact.

Shrimp farming is very promising for Vietnam and the world. This is also one of the industries that needs to be developed in the young generation with modern technology and is expected to bring high economic efficiency in the aquaculture industry in the countries.